Health sovereignty refers to a country’s ability to take charge of the pharmaceutical production chain and ensure the health of its population. The more a country relies on others for its supply of active ingredients, excipients, and production, the less sovereign it becomes. Today, France and Europe are facing the challenges of declining health sovereignty. While there are several reasons for this, numerous public and private initiatives are being launched to address this issue.

State of drug production

Mapping French and European shortcomings

The first striking sign of declining European and French health sovereignty is the increasing limitation of production. In the case of drugs of major therapeutic interest, less than half of the necessary active ingredients are produced in Europe.[1] And within this continent, competition between neighboring countries is becoming increasingly fierce.[2] As for France, the proportion of domestically produced drugs does not exceed one-third. As a result, the country ranks 5th among drug-producing countries in Europe in 2021[3].

Another significant problem for France is the growing number of medecine shortages. Such situations are becoming more frequent, with shortages increasing more than twenty-fold over the past decade.[4] The French National Agency for the Safety of Medicines and Health Products (ANSM) has tallied over 3,761 stockouts, including for amoxicillin and paracetamol,[5] in 2022, which have affected many French citizens.

These two examples illustrate France’s loss of health sovereignty—it is simply no longer in the race.

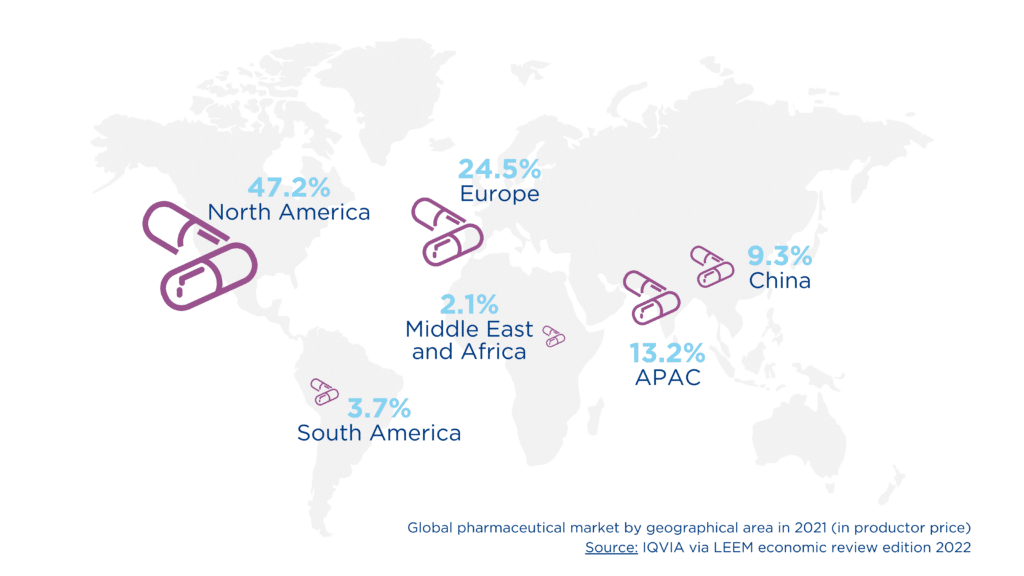

Global market figures also demonstrate the loss of momentum at the European level, with the market representing $1.29 trillion in 2021. Europe accounts for only 24.5% of the market share, in stark contrast to North America’s 47.2% and with an eye on China (9.3%), which is emerging as a key competitor.

India and China: dominant market players

The market share lost by France and Europe is inevitably gained by others, with China and India being particularly noteworthy rivals. China has established itself as a major supplier of active ingredients. For example, 85% of the world’s paracetamol, a key molecule in the pharmaceutical industry, is produced in Asia.[6] India, on the other hand, focuses on pharmaceutical production with great success. Ranked third globally in this strategically important sector, it has earned the title of “Pharmacy of the World.”.[7]

The rise of these new powerful players has led to production relocation. The pharmaceutical products they produce flood the European market, accounting for 40% of sales of finished drugs and 80% of the active ingredients used.6 This relocation results in dependence, and its origins need to be questioned.

Cost is the main reason for relocation. Two types of producers can be identified: on one hand, America and Western Europe, which are known for their quality and therefore bear higher production costs. On the other hand, Eastern Europe and Asia, where lower production costs are the main advantage. India and China are also very active in their domestic markets, encouraged by protectionist measures.[8] For example, in China, the recent protectionist trend is closing the medical technology market to foreign producers by slowing down certification processes and discriminating against importers in public procurement. Finally, the situation in France is not particularly favorable for pharmaceutical production. There are no such protectionist measures, many patents have fallen into the public domain, which de facto encourages pharmaceutical companies to focus on research, and market approval timelines are complex and lengthy, far exceeding those of other European countries. [9]

What are the key factors to restore French health sovereignty?

Relocating production

Production relocation means restoring France’s economic appeal. And to effectively restore this appeal, there are two options: promoting skills or providing subsidies.

Currently, in certain European countries including France, production relocation is a major objective of government policies. The France Relance 2030 plan, launched in June 2023, is moving in this direction and aims to:[10]

- Produce a list of 320 essential medicines for the treatment of the entire French population.

- Relocate the production of 25 key pharmaceutical products via a range of development projects, accompanied by an investment of 160 million euros.

- Develop future relocation projects with a budget of 50 million euros.

Without requiring new buildings, relocation projects can involve remodeling sites or extending their production capacity to multi-purpose formats. This is the option chosen by Lactalis Ingredients Pharma to take part in restoring France’s health sovereignty. From mainly French raw materials, we produce excipients for the pharmaceutical industry on the Retiers site, a long-established plant whose production techniques have been transformed and perfected, and which has been equipped with new technologies as part of an ongoing improvement process since 2016. Thanks to the size of the Lactalis group, the quantities of materials are substantial, avoiding any risk of shortages. Thus, our position as a partner of interest to European and French drug manufacturers is the result of a combination of a modernized site and new techniques accompanied by long-standing expertise. After more than fifty years of lactose production, we are putting our high level of expertise to work to adapt to the challenges posed by developments in the contemporary global market.

Limit waste and anticipate crisis

Concrete actions, both institutionalized, collaborative, and daily, are also key to restoring, or even reclaiming, French health sovereignty.

In Europe, the HERA (European Health Emergency Response Authority) aims to strengthen currently inadequate response capabilities and, ultimately, anticipate health threats and crises.

On a daily basis, it is also essential to ensure that a specific condition is associated with the right medication and dosage, and that the treatment is followed through to completion. Adherence to treatment is a prerequisite for minimizing waste, and it remains crucial to raise awareness about all these matters.

The loss of health sovereignty and increasing dependence are two parallel trends, which are therefore the focus of initiatives launched in France and Europe. These initiatives can be both public and private, as is the case with Lactalis Ingredients Pharma, and are centered around in-depth knowledge and consideration of all stages, from the production of active ingredients and excipients to manufacturing.

Sources

[1] Haut-Commissariat du Plan, Médicaments : Identifier nos vulnérabilités pour garantir notre indépendance, 9 février 2022

[2] Sénat Français, Pénurie de médicaments : trouver d’urgence le bon remède, juillet 2023

[3] EFPIA, Production pharmaceutique en Europe : 10 principaux pays producteurs

[4] ANSM, Rapports d’activité 2019 et 2020

[5] ANSM, Rapport d’activité 2022

[6] UNION -IHEDN, Accès aux traitements médicaux : un enjeu de sécurité et de souveraineté nationale, juillet 2022

[7] Government of India Department of Pharmaceuticals, Pharma Industry Promotion

[8] Ministère des Affaires étrangères et du développement international, ministère de l’Économie et des finances, PROSPECTIVE : Enjeux et perspectives des producteurs pour tiers de principes actifs et de médicaments

[9] Leem, Observatoire de l’accès aux médicaments et de l’attractivité, July 2023

[10] Elysée, Renforcer notre souveraineté sanitaire, July 2023