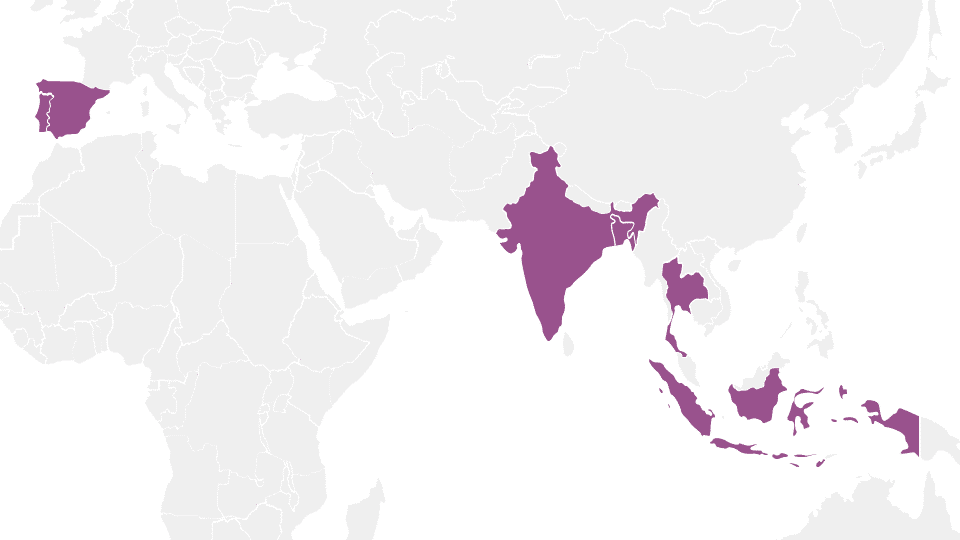

This February 2024, Lactalis Ingredients Pharma signed a new distributorship agreement with DKSH for the distribution of its range of pharmaceutical lactose. In Asia, DKSH will support the supply of Lactalpha in India, Bangladesh, Indonesia and Thailand, and complete our distribution with SAFIC ALCAN in Europe, in Spain and Portugal.

A partnership with DKSH based on Trust and Expertise

This partnership is a significant step forward for Lactalis Ingredients Pharma, as DKSH is a leading global distributor of pharmaceutical ingredients, especially in Asia which holds significant markets.

Indeed, DKSH has been thriving in Asia for over 150 years, building an in-depth expertise on pharmaceutical ingredients and a wide product portfolio, from Active Pharmaceutical Ingredients to Excipients.

We believe that their extensive network over India and the Pacific region, added to their 1 650 specialists on 33 markets, make the distributor a reliable partner both for us valuing the collaboration with industry experts, and for our clients being able to source their formulas from a single renown distributor.

Si on a : photo du stand de DKSH avec notre logo ou notre vidéo qui tourne sinon mettre photo du post de Linkedin

Supplying Asia’s major and promising markets

Our partnership with DKSH will reach India, Bangladesh, Indonesia, and Thailand, that are territories with high demand for pharmaceutical grade lactose to produce originators and generics. As a matter of fact, India ranks 3rd worldwide by volume of production to supply a strong domestic market and more than 200 export countries. [1]

In Thailand, the domestic market expends by an average annual rate of 4.5% thanks to the expansion of the universal health coverage program across the country, making it the second largest market in size in South-East Asia, after Indonesia. [2]

Driven by the increasing purchasing power of its population, the domestic pharmaceutical Bangladeshi market is of great potential. [3] Over the last decade, it has grown three times and is expected to reach $6.68 billion by 2027. [4]

Reasserting our desire to supply Europe locally

As we recently showed in our article answering, “How can we respond to the loss of French and European health sovereignty ?”, as French suppliers, we are eager to follow the local pharmaceutical production. Indeed, as our country and Europe are currently facing shortages which are affecting many patients, we wish to supply the domestic market as it fights against the loss of momentum of the European market share. [5]

This wish aligns with the potential of Europe’s market and our agreement with DKSH to covert Spain and Portugal. In Spain, the pharmaceutical industry is a key contributor to the economy, as the country holds the 4th largest pharmaceutical market in Europe in terms of revenue. [6] This market is also dynamic, as it is expected to experience an annual growth rate of 5.56% from 2024 to 2028. [7] Portugal is also a strategic market, in growth since 2013 and especially in 2022 (+10.4% vs 2021), reaching more than 5 billion €. [8]

Contact us to learn why you should place your trust in our pharmaceutical lactose and receive Lactalpha samples.

[1] Indian Department of Pharmaceuticals. Pharma Industry Promotion. https://pharmaceuticals.gov.in/pharma-industry-promotion

[2] Thailand Board of Investment. Biopharmaceutical industry. 2022 https://www.boi.go.th/upload/content/Biopharmaceutical.pdf

[3] Bangladesh Investment Development Authority. Pharma & API. https://bida.gov.bd/pharma-api

[4] The Daily Star. Huge export market awaits pharma industry. March 2023. https://www.thedailystar.net/business/economy/news/huge-export-market-awaits-pharma-industry-3270616

[5] ANSM. Rapport d’activité 2020 https://ansm.sante.fr/actualites/lansm-publie-son-rapport-dactivite-2020

[6] Statista. Pharmaceutical industry in Spain – statistics & facts. https://www.statista.com/topics/7980/pharmaceutical-industry-in-spain/#topicOverview

[7] Statista. Pharmaceuticals – Spain. https://www.statista.com/outlook/hmo/pharmaceuticals/spain

[8] apifarma. Mercado Farmacêutico. https://apifarma.pt/indicators/mercado-farmaceutico/