Each year, the pharmaceutical industry faces new challenges, and 2024 was no exception. From navigating complex regulatory landscapes to integrating cutting-edge technologies, the industry has had to adapt and innovate continuously.

In 2024, we witnessed significant advancements in personalized medicine, the rise of telehealth, and the ongoing battle against global health crises. These developments have reshaped the way pharmaceutical companies operate and interact with healthcare industries and patients.

As we look ahead to 2025, Lactalis Ingredients Pharma must remain alert to the pharmaceutical market challenges which affect and will affect drug producers. Let’s dive into 2024 main trends to identify how to remain a sustainable excipient supplier for our customers.

MAJOR TRENDS AND INNOVATIONS

Reducing time to market medication

Pressure to bring drugs to market faster has been building as the industry faces ongoing challenges from rising marketing costs, tightening competition and looming patent expirations. Developing new drugs is a long, slow and regulated process. By modernizing the processes and way of working, many drugs could be brought faster to market.

- Increasing Use of AI

Artificial intelligence (AI) continues to revolutionize the pharmaceutical industry. In 2025, its use is expected to intensify, with applications ranging from molecular design to predicting drug interactions. AI helps reduce R&D costs, accelerate the development of new drugs, and improve treatment outcomes. Additionally, AI plays a crucial role in personalized medicine by analyzing patient data to develop tailored treatments. This technology promises to transform the way drugs are discovered, developed, formulated, and administered.

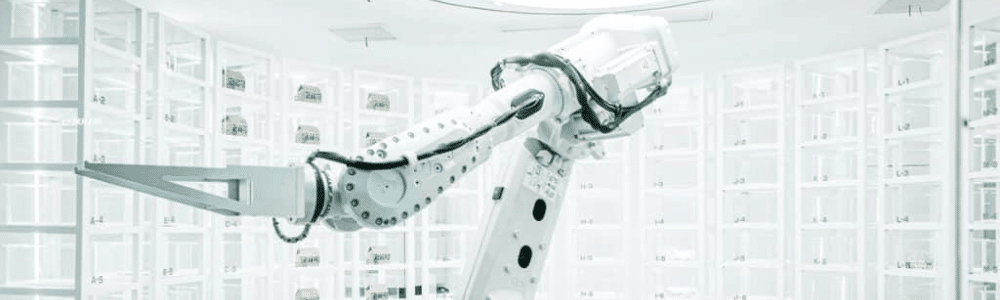

- Pharmaceutical production: growing interest in continuous manufacturing processes

The pharmaceutical industry is undergoing a significant transformation with the increasing adoption of continuous manufacturing processes. Unlike traditional batch production methods, continuous manufacturing allows for more efficient and flexible drug production. This approach reduces downtime, improves product quality, enables a faster response to market needs, and minimizes environmental impact (reducing emissions by 17% to 20%). In 2025, this trend is expected to intensify as companies seek to optimize their operations and reduce costs while maintaining high-quality standards. In this trend, the production of tablets by direct compression will probably increase as it stands for an interesting alternative to traditional dry or wet granulation processes.

Towards more oral solid dosage (OSD) forms – transitioning injectables to oral administration

The pharmaceutical market is increasingly adopting Oral Solid Dosage (OSD) forms by transitioning certain injectables to oral administration. This shift is driven by the convenience and comfort for patients, as well as cost efficiencies in production, packaging, and storage at ambient temperatures. Additionally, it reduces nursing care costs and medical waste. For successful transition, excipients must protect the active ingredient from the oral cavity to its absorption site, overcoming the gastric barrier. In 2025, research will focus on improving bioavailability, controlled release, and innovative formulations to meet patient needs and optimize industrial processes.

We consider today that lactose is used in 60% to 70% of oral solid doses, tablets can content in average from 0,2 g to 1,4 g. As consequence and in a long-term view, the demand of lactose will probably increase as it is a staple for OSD formulations.

Corporate Social Responsibility (CSR[1]) in the Pharmaceutical Industry

In 2024, the pharmaceutical industry made significant strides in corporate social responsibility, focusing on several key environmental areas.

Reducing and recycling chemical waste has also been a priority. Initiatives include the development of advanced waste treatment facilities that neutralize harmful substances before they are released into the environment, and programs that encourage the safe disposal and recycling of unused medications.

Water consumption management has been another area of focus, with water management programs designed to reduce usage and improve efficiency. Water recycling systems have been installed they allow to reuse water in production processes, significantly cutting down on overall water consumption.

Packaging management has evolved as well, with increased adoption of circular economy practices. This includes using biodegradable or recyclable materials for packaging and reducing the amount of packaging used. Additionally, the introduction of take-back programs for used packaging, ensures it is properly recycled.

The industry has intensified efforts to reduce CO2 emissions by optimizing production processes and utilizing renewable energy sources. For example, some companies have implemented energy-efficient technologies in their manufacturing plants and switched to more engaged suppliers toward environmental protection. Local sourcing when possible is also a lever to decrease carbon emission while limiting risks of supply disruption as it was often the case during covid pandemic.

National and European Initiatives

In France, a collective charter[2] “for fair patient access to medicines subject to supply tensions” was signed in November 2023. This initiative, led by the French Ministry of Health and Prevention, brought together many stakeholders, including manufacturers, wholesale distributors, and pharmacists, under the aegis of the National Agency for the Safety of Medicines[3] and Health Products and the French Chamber of Pharmacists.[4]

In 2024, further measures were envisaged to address these challenges. These include the convergence of European legislation to harmonize regulations, revitalizing investment to secure the long-term future of the industrial base and strengthening strategic autonomy. Adjusting drug prices and adopting standard measures for monitoring and managing stock-outs are also key components. The primary challenge now lies in the effective implementation and monitoring of these measures to transform promising ideas into concrete actions.

As actors and observers of trends in this sector, Lactalis Ingredients Pharma (LIP) recognizes the importance of these initiatives. We have observed significant efforts to reduce dependency on external sources and ensure a stable supply of essential medicines. For example, companies have been working on improving the resilience of supply chains by diversifying sources of raw materials and increasing local production capacities.

These efforts demonstrate a commitment to not only addressing immediate supply issues but also building a more robust and self-sufficient pharmaceutical sector in the long term.